Georgia Dental Insurance Services

Protect Your Loved Ones and Your Assets.

Save thousands of dollars on business and personal lines of insurance along with discounts on products and services that support you and your dental practice.

Let us create a customized plan for you, your family, and dental team.

Georgia Dental Insurance Services

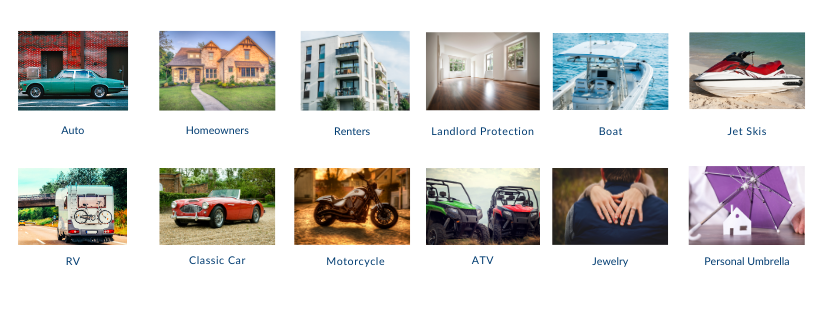

GDIS offers insurance coverage for every stage of your career and every part of your life, including products for your family, personal assets and dental teams.

LEARN MORE

Attentive, personal customer service, for all your insurance needs.

Our team is made up of experienced agents who are dedicated to finding the best, most cost-effective ways to give you and your practice the security you deserve. We are available to review your current policies, answer questions, and provide quotes for each of your insurance needs – and we ensure that you receive competitive rates that provide comprehensive, successful coverage. Not only do we provide exceptional services to our member dentists, we also offer a variety of products and services to protect your family, friends, and dental staff. Give us a call today or complete the form below to request a confidential consultation.Our History

Request a Confidential Consultation

Professional Liability Coverage

GDIS provides professional liability policies to protect dentists if a malpractice lawsuit is brought forward. Our competitively priced coverage typically provides for both defense costs and indemnification or any damages deemed payable to the plaintiff.

Did you know:

-

The average dentist can expect to see at least one claim in his or her career.1

-

As of December 2019, the National Practitioner Data Bank (NPDB) shows the average dental malpractice payout is about $88,400.2

Don’t hesitate to contact us today for your free quote and policy review.

1 American Dental Association, Health Policy Institute, Surveys of Dental Practice. Average Number of Patient Visits per Dentist 2017.

2 National Practitioner Data Bank Public Use File, December 31, 2019. Five-year average 2015-2019.

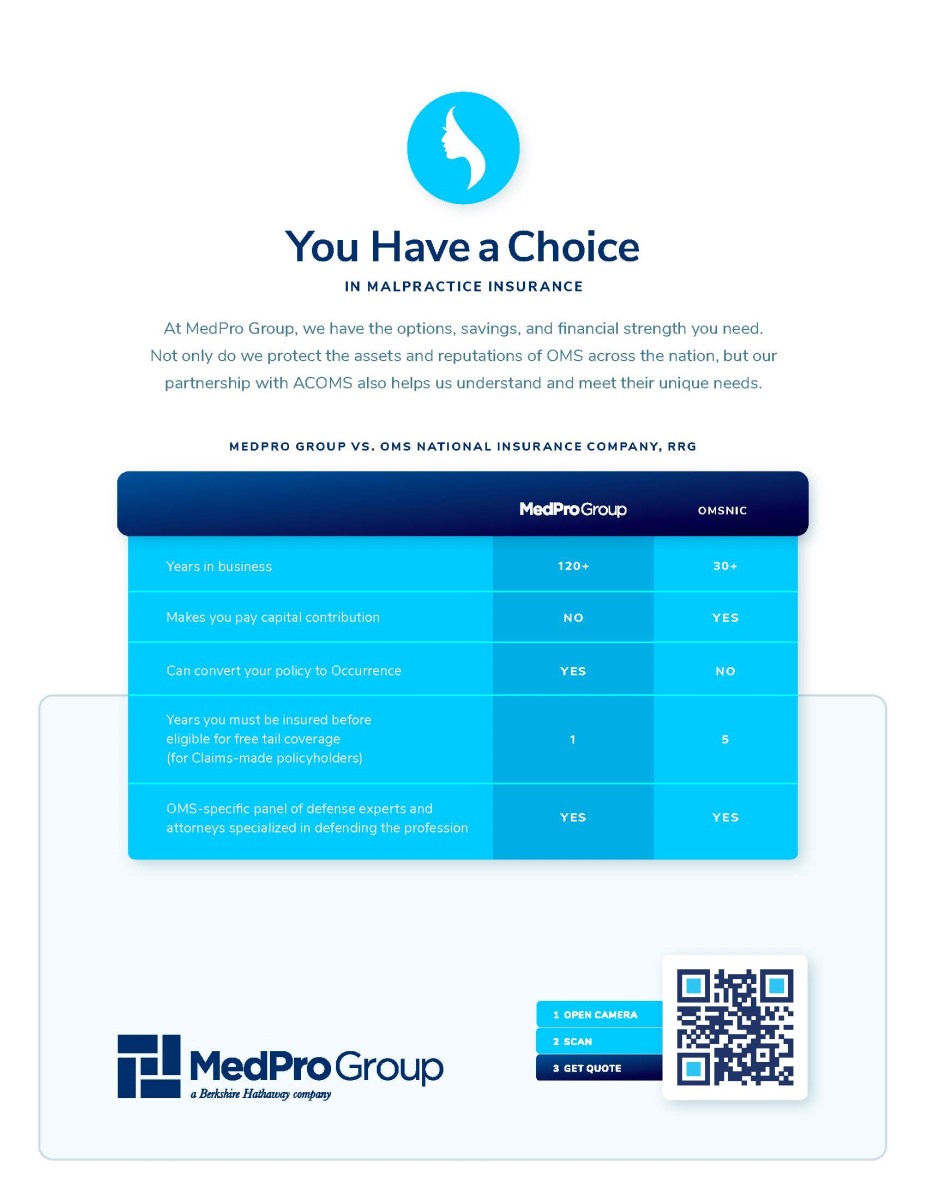

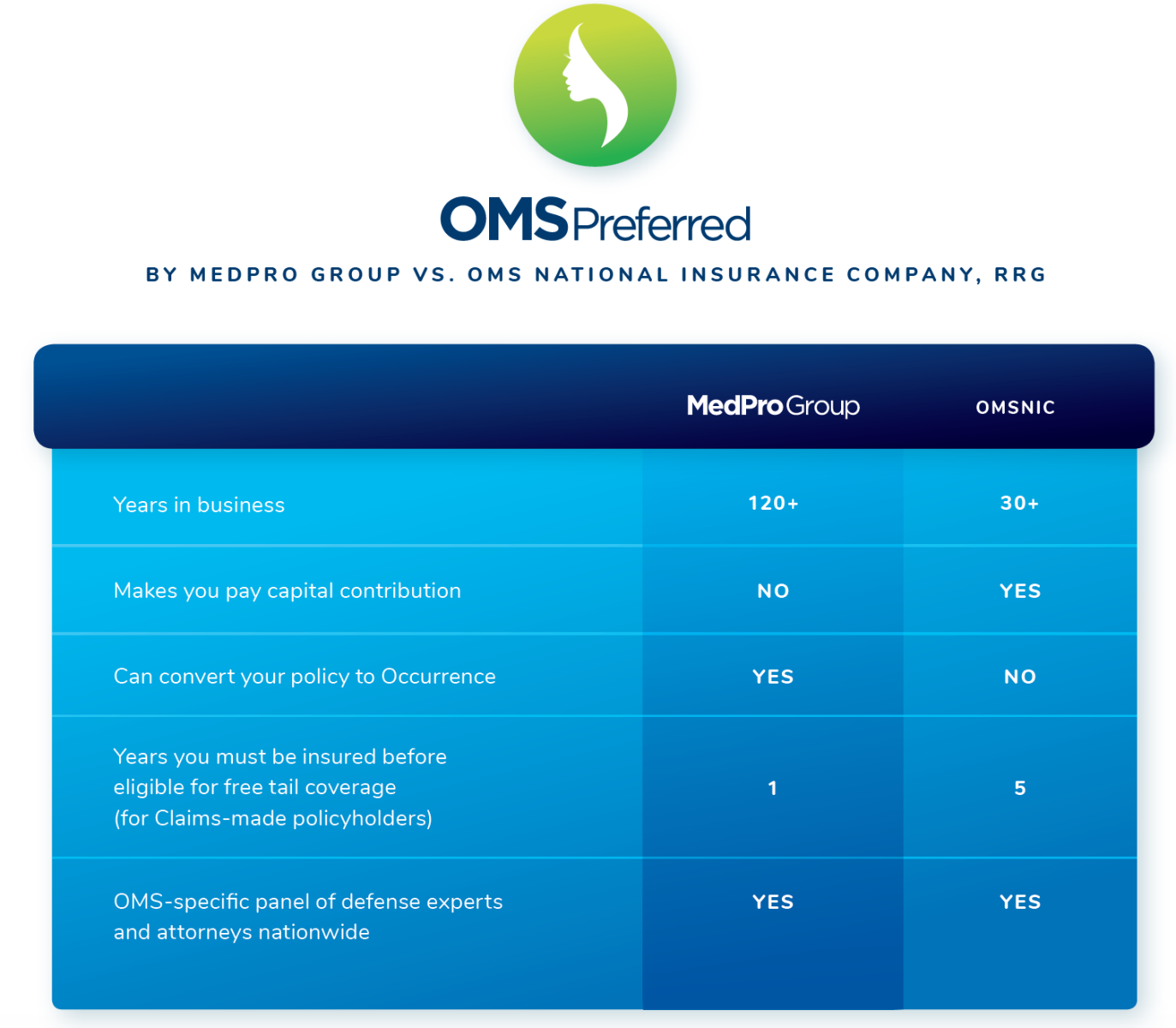

Our Partner MedPro Group

Liability Coverage from an Industry Leader

You want peace of mind, expertise, and stability from your professional liability insurance provider – and GDIS is proud to work with MedPro, a strong, reliable partner. Learn a little more about the strength of our coverage, and why it can help you protect what matters:

PEACE OF MIND

- A Berkshire Hathaway Company

- Unsurpassed financial strength ratings: A++ (A.M. Best)

-

Pure consent provision gives you control to refuse to settle a claim

EXPERTISE

- Over half a million claims managed since 1899

- 95% dental and OMS trial win rate; 80% of dental claims closed without payment

-

An Advisory Board of experienced dentists who review claims and offer insights

CHOICE

- Customized insurance, claims and risk management solutions

- Comprehensive coverage in all 50 states and D.C.

-

Claims-made, Occurrence, and Convert to Occurrence® coverage options give you flexibility

Malpractice Protection from MedPro Group

Your trusted GDIS team is excited to offer you professional liability insurance through MedPro Group — an industry-leading carrier providing comprehensive coverage at a competitive cost. We believe you shouldn’t have to pay high fees to get the claims handling and risk management experience you deserve.

Get a QuoteOffering Superior Protection

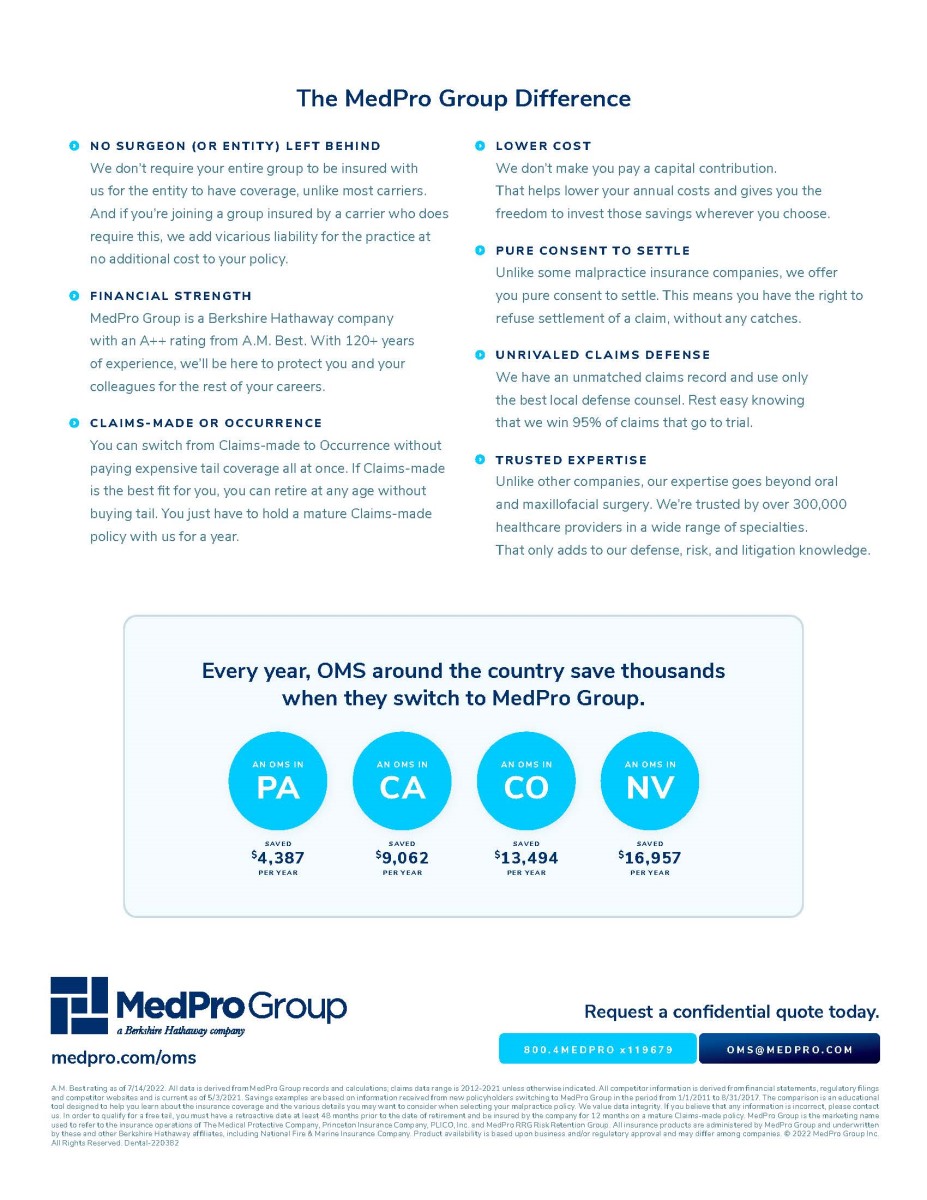

MedPro Group is the only insurance carrier to offer OMS:

BETTER COST

You won’t pay capital contributions when you switch. In fact, we have a variety of premium credits which have helped OMS save thousands on their annual premiums.

BETTER DEFENSE COVERAGE

We defend OMS using 120+ years of claims experience across the healthcare spectrum and the nation’s leading defense counsel. These are some of the reasons we close 80% of claims without payment and hold a 95% trial win rate.

BETTER CARRIER

We’re the strongest carrier in the industry—a Berkshire Hathaway company with an A++ rating from A.M. Best. Our unmatched financial stability combined with our successful defense track record allows us to fiercely defend claims while maintaining affordable premiums.

Winning a malpractice case often requires resources outside of the OMS profession. That’s why we defend you using 120+ years of claims experience across healthcare, the nation’s leading defense counsel, and over 7,000 of the best expert witnesses.

If your company only insures OMS, they may not have the breadth of resources and insights to best defend your case. Being covered by a company with experience across professions can be the deciding factor in a malpractice lawsuit — and we have the winning record to prove it. We close 80% of claims without payment and hold a 95% trial win rate.

2026 Group Health Plans Webinar

2026 Group Health Plans

- 3 exceptional health plans to choose from (one is HSA compatible)

- Age-banded rates which offer a more equitable approach by aligning premium costs more closely with the actual cost of care

- Trusted partnership with a recognized leader in healthcare innovation

- Broad network options

- Optional low-cost vision coverage

- Basic term life benefit of $10,000 on primary insured up to age 65

- Rate guarantee for one year

- No health questions on enrollment

- High satisfaction level with personal customer service

- Continued access to reliable coverage

View 2026 Health Plan Benefits Guide

Plans and rates begin on page 6.

In 2016, hundreds more Georgia dentists found competitive, comprehensive coverage thanks to GDA Plus+ Insurance/GDIS and our partner The Hartford. From business policies to worker’s compensation coverage, we can provide high quality, attentive service – and help you consolidate all your policies with one company, endorsed by your Georgia Dental Association.

In 2016, hundreds more Georgia dentists found competitive, comprehensive coverage thanks to GDA Plus+ Insurance/GDIS and our partner The Hartford. From business policies to worker’s compensation coverage, we can provide high quality, attentive service – and help you consolidate all your policies with one company, endorsed by your Georgia Dental Association.